UK Chancellor Rachel Reeves is urging Britons to invest more in UK stocks, pushing for a shift from traditional cash savings towards capital markets. This initiative aims to boost economic growth, create jobs, and offer individuals a more robust source of future income, recognizing the potentially higher long-term returns from investing compared to saving.

Contents

Key Takeaways:

- Only 23% of UK individuals (excluding pensions) invest in the stock market, significantly lower than the US.

- Media coverage focusing on market downturns may deter potential investors, despite historical quick rebounds.

- Low-cost Exchange-Traded Funds (ETFs) offer accessible ways to diversify and invest long-term.

- Understanding and navigating short-term market volatility is crucial for realizing long-term investment benefits.

The UK’s Investment Gap: Cash vs. Stocks

Despite the clear benefits, UK stock ownership outside of workplace pensions stands at just 23%, a stark contrast to nearly two-thirds in the US. This disparity suggests a greater comfort with financial risks among American consumers. While stock market participation can fuel business expansion and job creation, many Britons opt for safer assets like cash savings accounts or premium bonds, often influenced by a more risk-averse cultural attitude.

Historically, encouraging individual stock ownership is a strategic goal for governments. It strengthens capital markets, which in turn can lead to a more vibrant economy. For individuals, long-term investing offers a pathway to potentially greater wealth accumulation, providing a crucial income stream later in life, especially when compared to the typically lower returns of cash savings.

Illustration showing a person looking thoughtfully at a graph, representing financial decision-making or investment choices in the UK context.

Illustration showing a person looking thoughtfully at a graph, representing financial decision-making or investment choices in the UK context.

How Media Shapes Investor Perception

One significant factor contributing to this caution is the media’s portrayal of financial markets. News coverage tends to be more prominent and “noisier” when markets fall than when they recover. While concerns regarding market volatility are valid, this imbalanced reporting can overshadow the substantial long-term benefits of investing, making the market appear riskier than it is over extended periods. This focus on immediate downturns can deter new investors and instill fear in existing ones.

Unlocking Opportunity: Exchange-Traded Funds (ETFs)

Many British consumers have missed out on the accessibility offered by low-cost, diversified Exchange-Traded Funds (ETFs). ETFs allow investors to buy or sell a basket of shares on an exchange, providing exposure to a wide range of companies without the need to purchase individual stocks. For instance, a FTSE100 ETF grants investors exposure to the UK’s top 100 companies through a single investment, making diversification simpler and more affordable. This type of long-term, low-cost investing aligns directly with the Chancellor’s vision.

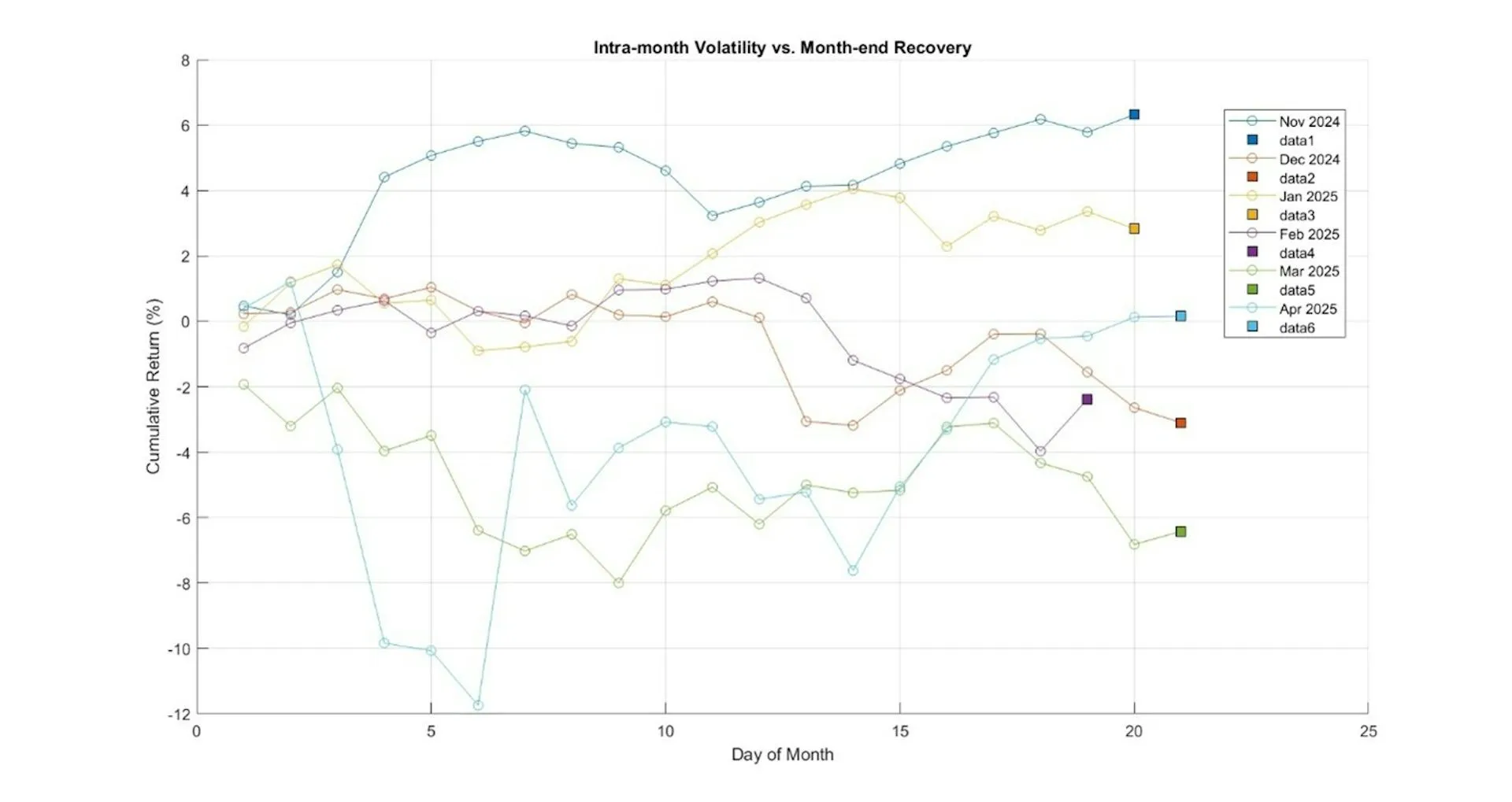

While current market volatility, often driven by trade tensions and geopolitical uncertainty, might seem concerning, it’s essential to view it within a broader context. Volatility is an inherent part of the investment landscape. Examining daily excess returns in the US stock market, for example, reveals a common pattern: despite sharp daily losses, markets often rebound swiftly in the days that follow, demonstrating remarkable resilience to short-term shocks.

Graph illustrating the swift rebound of US stock market cumulative returns after sharp daily losses, showing historical market resilience.

Graph illustrating the swift rebound of US stock market cumulative returns after sharp daily losses, showing historical market resilience.

This historical trend of quick recovery is often overlooked in alarming headlines that highlight single-day declines without providing the necessary broader context. The reality is that the stock market frequently experiences brief periods of turbulence, which are often followed by calm and recovery, underscoring the importance of a long-term perspective.

Overcoming “Fear and Caution” for Long-Term Success

During market downturns, it’s common for media narratives to emphasize why “this time is worse” or to analyze if a crash is more severe than previous ones. The fear generated by these headlines can create significant barriers to promoting long-term investing in the UK. This represents a key challenge for the Chancellor in her bid to encourage greater public participation in the stock market.

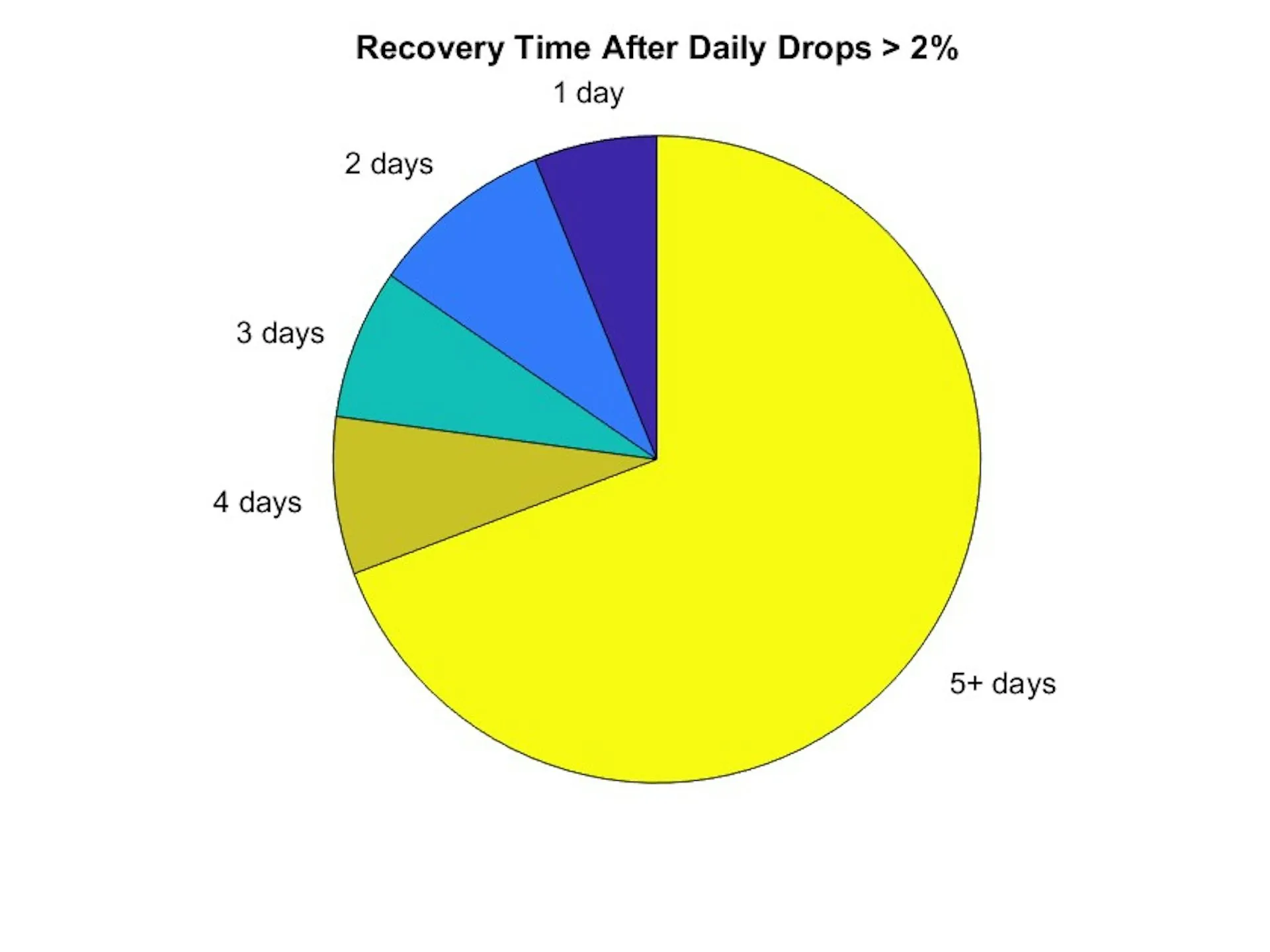

For those already invested, short-term declines are an expected part of the journey. These risks are typically borne with the understanding that markets tend to recover over time. Analysis of daily US stock market data since 1926 indicates that after sharp daily drops, the market often rebounds quickly, with more than a quarter of recoveries occurring within just a few days.

Pie chart visualizing data from 1926, showing that over 25% of stock market recoveries occur within a few days of significant drops.

Pie chart visualizing data from 1926, showing that over 25% of stock market recoveries occur within a few days of significant drops.

However, this resilience rarely receives the same media attention. It’s far more common to see headlines reporting market downturns than follow-ups highlighting how swiftly they bounce back. Research suggests that negative economic information disproportionately impacts public attitudes. For example, a sharp drop might dominate front pages, while a steady recovery barely gets a mention, reinforcing a sense of crisis even when the broader picture is less bleak. This unbalanced reporting can distort perceptions, discouraging potential investors who could otherwise benefit from sustained market participation.

Front page of a newspaper from April 2025 with a prominent headline, symbolizing media focus on market downturns rather than subsequent recoveries.

Front page of a newspaper from April 2025 with a prominent headline, symbolizing media focus on market downturns rather than subsequent recoveries.

The Path Forward for UK Investors

The “equity risk premium puzzle”—the long-standing debate among economists about the significant gap between stock market returns and lower government bond returns—highlights the historical advantage of investing in UK stocks. While some observers predict this gap may narrow, many, including the Chancellor, firmly believe that stock market investment remains a beneficial long-term strategy.

For more people to benefit from the potential of long-term investing, it is vital to tell the complete story. This means not only reporting when markets fall but also following up on how swiftly and consistently they recover. Understanding this broader context can empower curious professionals and casual investors alike to make more informed and confident decisions about their financial future.

For further insights into navigating market dynamics, explore our related articles: